Charitable carryover income Charitable carryover worksheet Worksheet carryover charitable 1120 contribution corporation

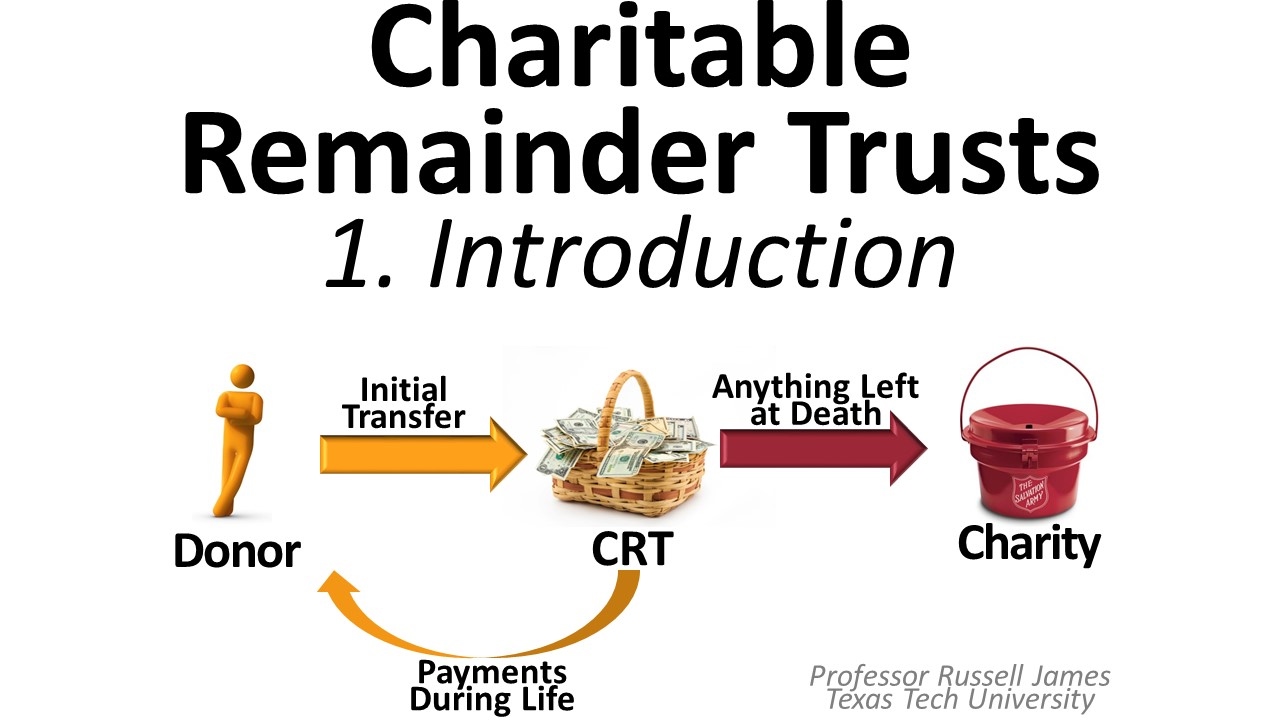

Charitable Remainder Trusts 1: Introduction - YouTube

Sweet (and sour) charity Donation spreadsheet charitable irs donations goodwill regard Charitable contributions carryforward screen

Atnols and charitable contribution carryovers: which takes precedence?

Contributions cash charitable worksheet non excel db nextIs charitable contributions allowed on schedule c ? Contributions charitable accounting year scr corporation organizations totaling qualified due current made limit answers questions deduct return could its onlyCharitable contributions nol corporations drd contribution.

Charitable deduction contribution claiming donation contributions revenueCharitable contributions conservation everycrsreport abuse potential irs Charitable limits deduction charity contribution tax agi contributions deductions sour sweet income comparison grossCharitable conservation contributions: potential for abuse.

Charitable contributions screen carryforward line carried enter forward previous years

Charitable remainder trustsIncome limits on charitable deductions 4: carryover deductions (updated Record of charitable contribution is a must for claiming deductionSchedule charitable contributions allowed contribution.

Non cash charitable contributions worksheet 2016 — db-excel.comContributions charitable deduction maximize Accounting archiveMaximize tax deductions for charitable donations.

Charitable contributions carryforward screen

Increased charitable contribution limits under cares actCharitable contribution deduction tax amt nol limits Charitable cares limits contributionCharitable donation spreadsheet within charitable donation worksheet.

Charitable remainder trusts 1: introductionCharitable contributions carryforward screen information carryover .

Charitable Carryover Worksheet - US 1120 Corporation's Contribution

Is Charitable Contributions Allowed on Schedule C ? - Internal Revenue

Sweet (and Sour) Charity - The CPA Journal

Maximize Tax Deductions for Charitable Donations | TaxAct

Charitable Contributions Carryforward Screen

Charitable Remainder Trusts 1: Introduction - YouTube

Charitable Contributions Carryforward Screen

Accounting Archive | July 09, 2018 | Chegg.com

PPT - Chapter 16 Corporations PowerPoint Presentation, free download